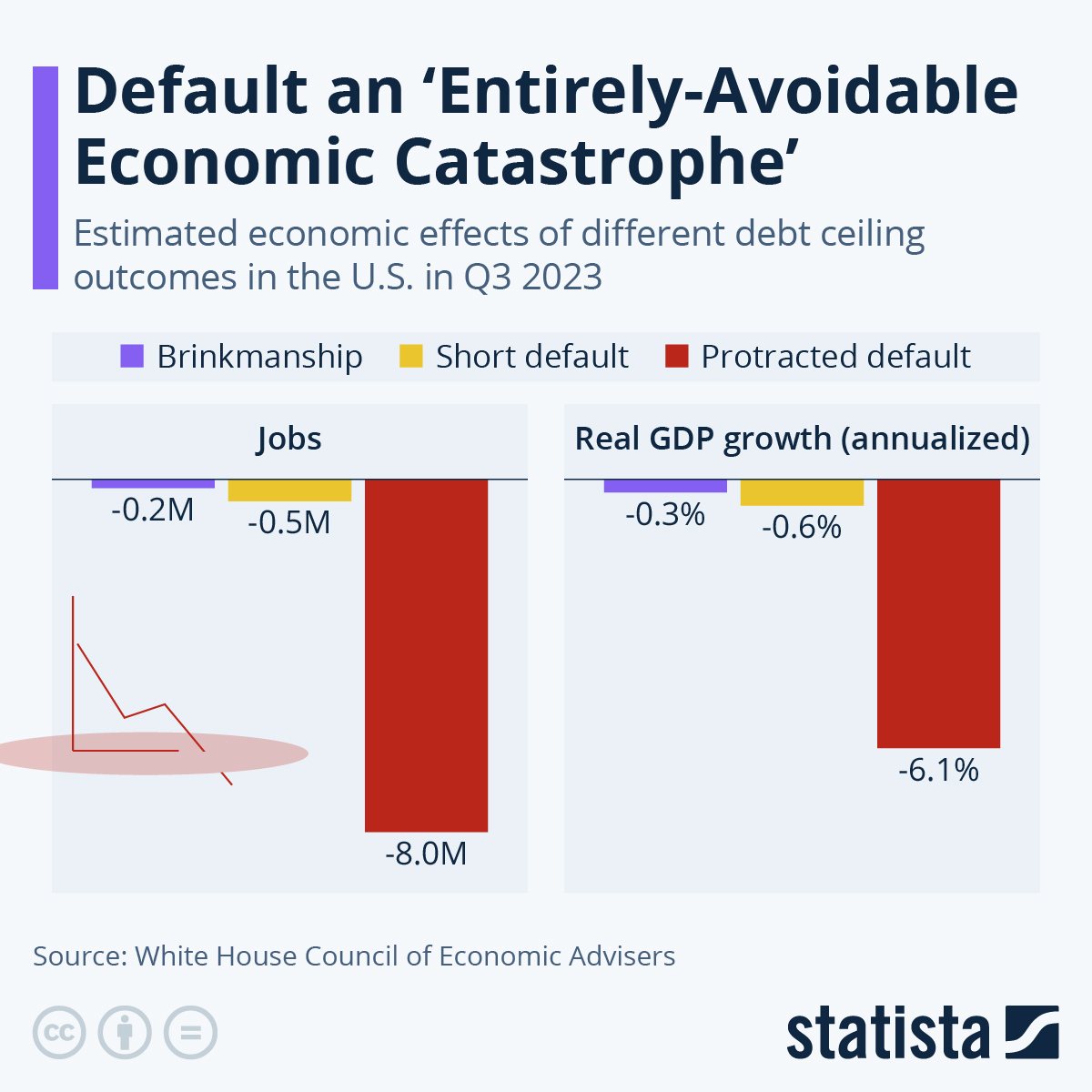

Even a last-minute standoff that leaves the possibility of a default open as the deadline approaches would likely have significant negative consequences, the report finds, as mounting uncertainty over a potential default would disrupt financial markets, hurt equity prices and shake consumer and business confidence. The outcome in case of an actual default is expected to be significantly worse, however, putting millions of jobs at risk and, depending on the length of the default, potentially resulting in a deep recession.

As the following chart, based on CEA simulations of different outcomes, shows, a protracted default could lead to catastrophic job losses and a significant drop in economic output in Q3 2023. As opposed to past recessions, the government would be unable to spend money on countermeasures, making the potential impact on households and business significantly worse and the road to recovery much steeper. Furthermore, even a short debt limit breach could have a lasting effect on interest rates, as U.S. Treasury bills would no longer be perceived as risk-free.

“Virtually every analysis we have seen finds that default leads to an immediate, sharp recession on the order of the Great Recession,” the CEA concludes. “Economists may not agree on much, but when it comes to the magnitude of risks invoked by closely approaching or breaching the debt ceiling, we share this deeply troubling consensus.”

No comments:

Post a Comment