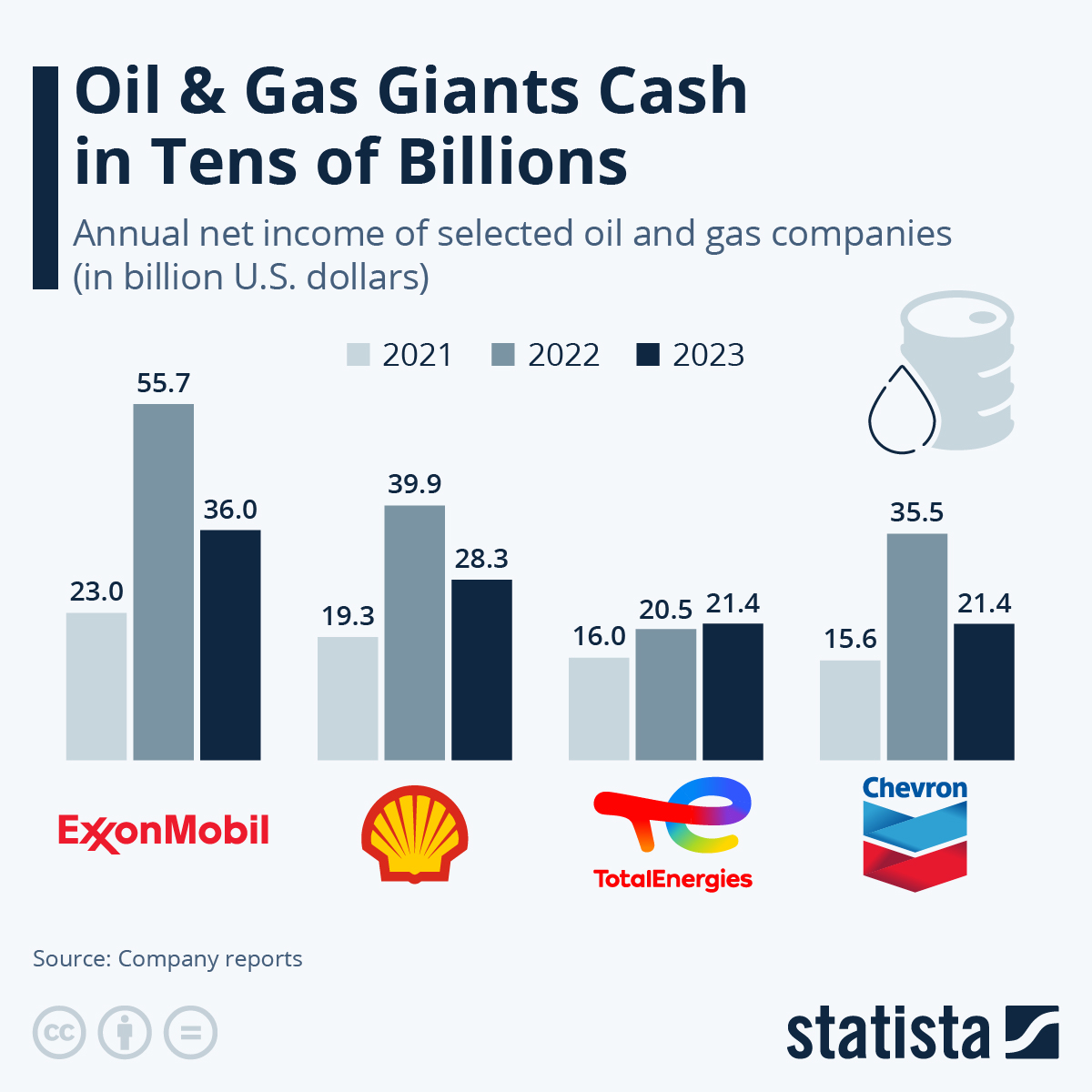

As our chart shows, the U.S. energy companies Exxon and Chevron have seen the biggest leaps in their profits. Compared to last year's second quarter, Exxon’s earnings skyrocketed from $4.7 billion to $17.9 billion, while Chevron’s grew from $3.1 billion to $11.6 billion.

Gas prices in the U.S. have risen by more than $1 a gallon on average since 2021. It’s a similar tale in Europe, where energy prices are threatening to push the bloc’s largest economies into recession. This isn’t only costing consumers more at the pump, but also in terms of heating and deliveries, with UK media reporting that people are already having to choose between warmth and food. One possible countermeasure carried out in countries such as Greece, Spain and Italy - and currently contemplated in multiple others - is to introduce a windfall tax on Big Oil companies to ease the burden on low income and middle income households.

While these companies have been criticized for capitalizing on the fuel crisis following Russia’s invasion of Ukraine and fuelling the cost of living crisis, it is worth noting here that BP exited its stake in Russian oil giant Rosneft in February, at a cost of some $25 billion; which Reuters writes is the “most significant move yet by a Western company in response to Moscow's invasion of Ukraine.”

Вчера ехал из Минска в Москву, заметил, что на TEBOIL никого нет, не взирая на скидку (TEBOIL — это бывшая Shell), а на LUKOil — полно народу.

Вчера ехал из Минска в Москву, заметил, что на TEBOIL никого нет, не взирая на скидку (TEBOIL — это бывшая Shell), а на LUKOil — полно народу. Мб, и-за того, что сортиры уменьшили?

1 comment:

Глава ООН Гутерриш призвал нефтегазовые компании не обогащаться на войне

Генеральный секретарь ООН Антониу Гутерриш раскритиковал нефтегазовые компании, зарабатывающие на энергетическом кризисе, отчасти обусловленном войной в Украине.

"Аморально, когда нефтяные и газовые компании делают рекордную прибыль на этом энергетическом кризисе, на самых бедных людях и сообществах", - заявил Гутерриш.

Он призвал национальные правительства увеличить налоговую нагрузку на нефтегазовый сектор.

Две крупнейшие американские энергокомпании - Chevron и Exxon Mobil - и две европейские - французская Total и британская Shell - за последний квартал заработали около 51 млрд долларов. Это в примерно в два раза больше, чем в первом квартале 2021 года.

Всего же крупнейшие нефтегазовые компании отчитались о прибыли почти в 100 млрд долларов. Гутерриш назвал их политику проявлением "гротескной жадности".

https://t.me/bbcrussian/32577

Post a Comment