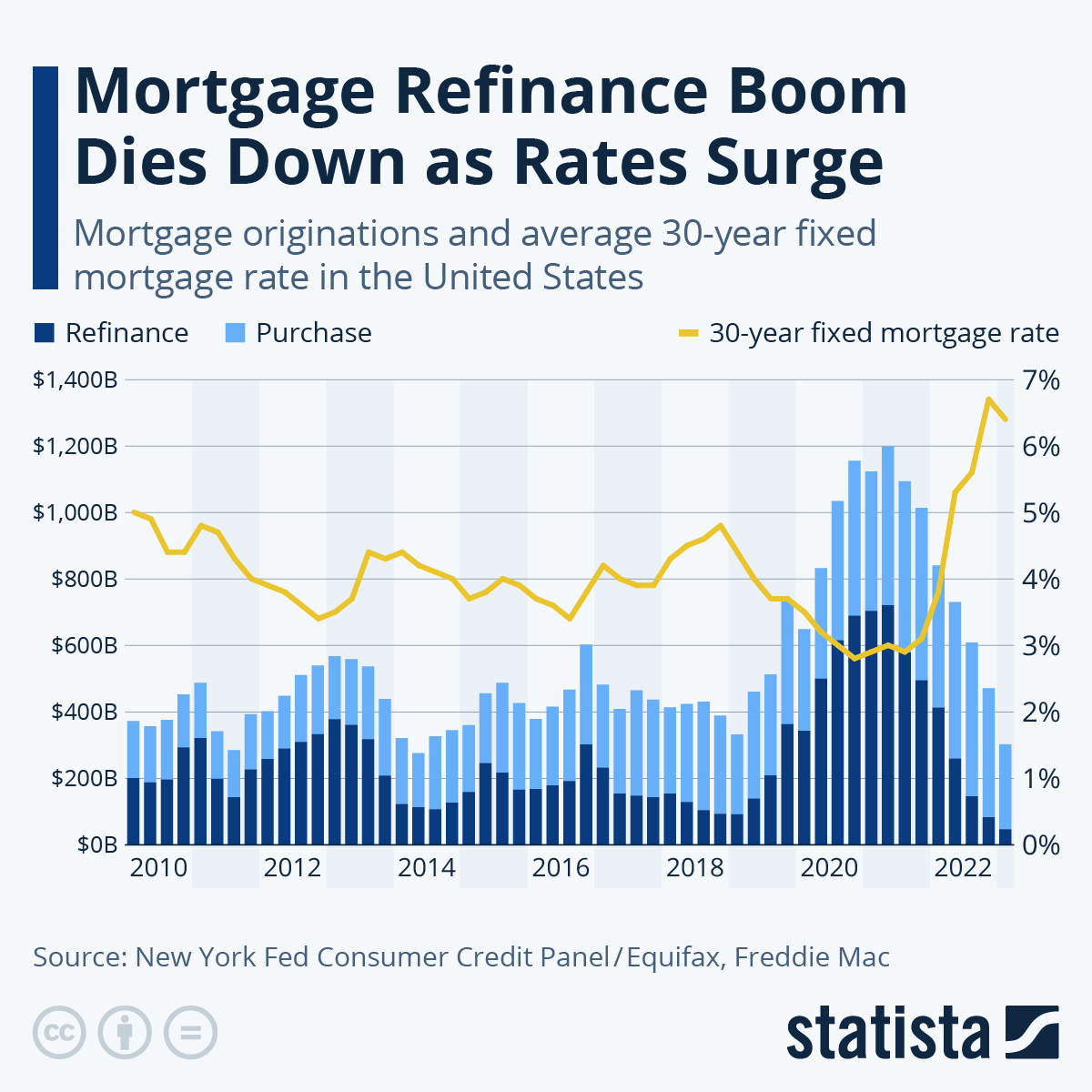

Homeowners are best situated to take advantage of the current market environment because they stand to profit from high house prices as well as low rates, while prospective buyers will see the positive effect of low mortgage rates at least partly canceled out by high home prices. Many homeowners even decide to take some cash when refinancing their mortgage, taking full advantage of their home equity. According to Freddie Mac, home owners cashed out $150 billion refinancing their mortgages last year, marking the highest volume since 2007.

As the following chart shows, mortgage refinances in Q4 2020 and Q1 2021 even surpassed the level seen during the refinance boom of 2003, albeit only in nominal terms. It also needs to be noted that back in 2003, only 30 percent of mortgage originations went to borrowers with excellent credit scores, while such super-prime borrowers accounted for more than 70 percent of origination volumein the past twelve months, making the current boom less worrisome than the 2003 refinance frenzy, which contributed to the financial crisis of 2008.

1 comment:

18+

нововведение?

Post a Comment