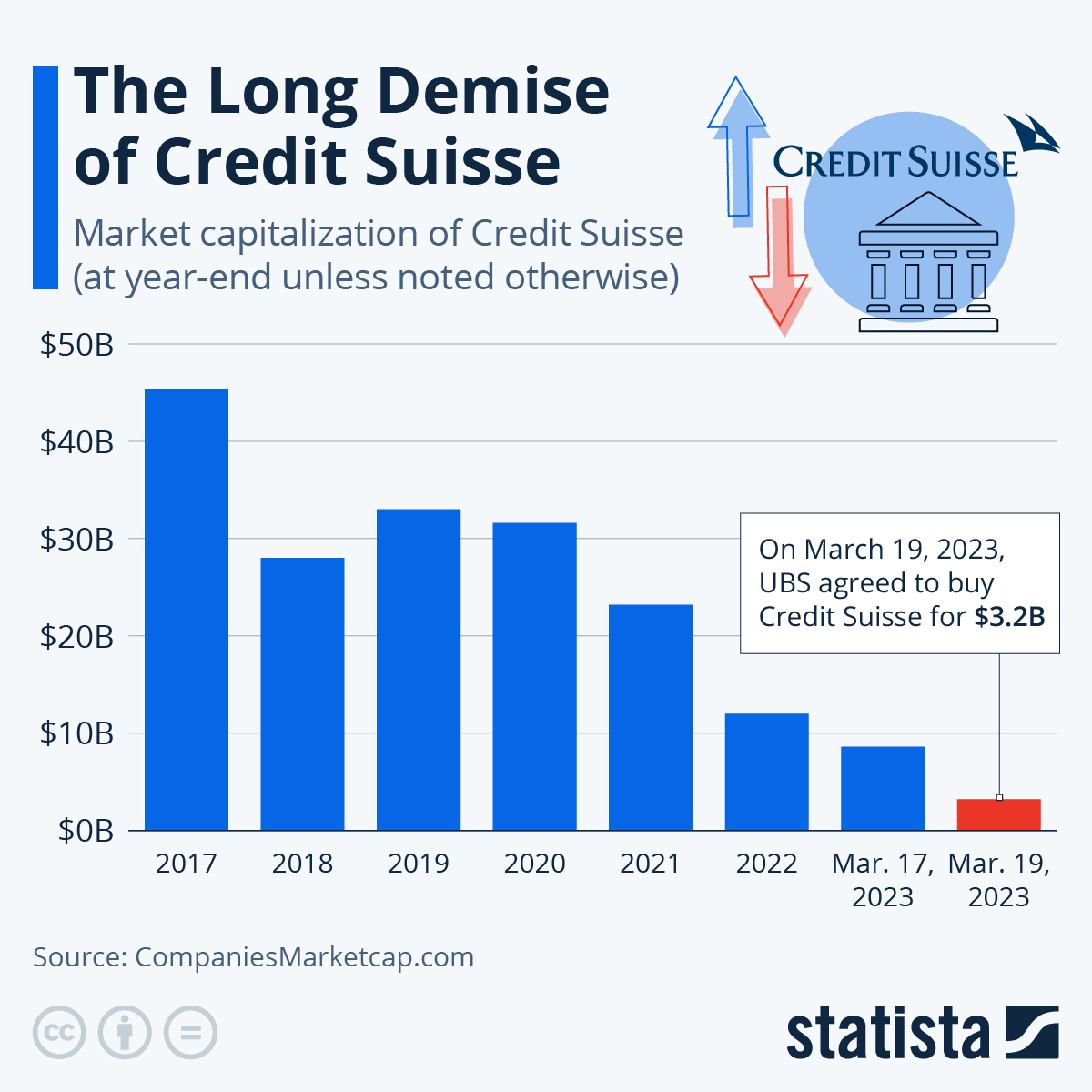

The deal, priced a staggering 60 percent below Credit Suisse’s market capitalization at Friday’s market close, marks the end of the 166-year-old institution and cements UBS’s status as the largest Swiss bank and one of the largest financial institutions in Europe. While not directly linked to the collapse of SVB and Signature Bank, Credit Suisse ultimately fell victim to the acute loss of confidence in the banking system, which turned the bank’s latest annual report into a giant red flag for clients and investors.

In the report published last Tuesday, the Zurich-based banking group not only acknowledged “material weakness” in its financial reporting, but it also posted a $7.9 billion loss for 2022 and confirmed substantial outflows of deposits and other assets under management that “have exacerbated and may continue to exacerbate” liquidity risks. Against the backdrop of the U.S. banking crisis, it’s no surprise that clients and shareholders were equally spooked, sending the bank’s stock price tumbling. By the end of week, it was down another 25 percent after having plummeted almost 70 percent in 2022.

Having been involved in a series of scandals and catastrophic deals in recent years, Credit Suisse has been on a downward trajectory for a while, seeing its market capitalization drop from $45 billion in 2017 to $12 billion by the end of last year. The bank’s acquisition by UBS marks the end of that development and what UBS Chairman Colm Kelleher called “an emergency rescue”.

1 comment:

Капитализация Credit Suisse, купленного на выходных UBS за скромные 3.2 миллиарда долларов, ещё несколько лет назад превышала 30 миллиардов долларов (а в 2017 и вовсе была около 45 млрд) - но последние годы у банка были проблемы, особенно обострившиеся в конце 2022

За 4 квартал 2022 чистый отток активов из банка составил впечатляющие 119 миллиардов долларов, объём средств клиентов, выведенных из банка - 149 миллиардов. Но даже на фоне этих проблем случившийся буквально в несколько дней обвал необычен - в том числе своей скоростью

+ другая картинка https://t.me/pornstat/5509

Post a Comment